Guiding Principles of How to Approch Growth

Atlas/Maps/Demand Curve Growth MOC

Now we’ll turn to a few key principles to bear in mind as you develop your own growth strategy. These principles are essential to remember because they’ll keep you focused on strategy, productive learning, and achievement. Here are the five principles we’ll cover:

1: Focus is key

2: Try fewer channels for more concentrated growth

3: Growth = learning

4: Leverage compounds

5: The staircase of growth

# Focus is key

- Summary: Focus on strategy. Not ad hoc attempts to grow.

- We see too many teams spread themselves thin. They write tweets, draft email newsletters, publish guest blog posts, etc., without clear knowledge of how these activities will lead to customers and revenue.

- To establish focus, we’re going to help you identify and perform repeatable activities that drive meaningful results for your revenue and customer base.

- You won’t be able to find those meaningful growth activities without testing them. Which leads us to the next principle.

# Try fewer chanels for more concentrated growth

- Summary: Focus on getting a few channels right, to avoid getting a lot of channels wrong.

- We work with lots of founders who have adopted the mentality that they should always be “doing more”—and doing more faster. Especially when it comes to growth. Startups that have hardly started marketing tell us about 10 different channels they’d like to test. Or they ask us how they can implement a sophisticated experimentation program so their team can start churning out at least 20 experiments a month.

- Or, on the other side of the equation, they’ll excitedly tell us how they found a channel that’s consistently and profitably generating new customers, only to immediately follow it up with how they think they should start testing more channels in order to “diversify.”

- We understand where these founders are coming from. Intuitively, it makes sense to test as many things as possible to figure out what works. But this mentality has some pitfalls.

- Why “more” isn’t better in acquisition strategy

- In the world of personal finance, we’re taught that ==diversification is the name of the game.== Why? Because you’re trying to reduce risk by spreading your money across stocks, instead of putting it all in a few stocks that you hope will take off. You’re probably not in a rush—retirement might be years down the road. So diversification serves a great purpose: It reduces risk and increases security.

- Contrast that with your typical startup. You don’t have 30 years. You may have enough capital to only last six months. This is an entirely different ballgame. You likely can’t survive on 10% annual growth rates. You need more significant growth, faster.

- To do that, you’re going to need to ==concentrate on only the channels that are most likely to work for you.== They’re the ones that will kick-start your growth. It’s riskier to try too many channels at once than it is to pick the ones that are best suited for your product, launch them, and evaluate their performance for continued optimization.

- Fewer channels means more concentrated investment, too

- It takes a lot of work (and often money) to get a single channel to work. You’re competing with many other companies for the attention of your market. Many companies have entire teams dedicated to one channel alone. To give yourself a chance to succeed, you need to give a channel the time and attention it requires.

- Here’s what goes into launching a single channel such as Facebook ads:

- Prepare for launch: You’ll conduct research, design ad creatives, write copy, set up your ad account, build your campaigns, set up pixels and conversion tracking, create landing pages, and more.

- Launch: You’ll likely be spending at least $2,000/month (and more if you want to accelerate your learnings). Plus, you’ll be closely monitoring and optimizing results. This takes time. And since you’re new to this, there will be a learning curve. Things often take longer than expected.

- Iterate: If your initial test looks promising, you’ll invest more resources into putting together new creatives and campaigns on an ongoing basis, as well as continually analyzing results and optimizing. You may also want to increase your spend to, say, $5,000 or $10,000/month.

- Imagine if you tried to test four other channels at the same time. Each channel requires its own research, ads, tracking, and so on. Plus, now your initial cost has increased 5x. And once you launch, you’ll have 5x as many channels to analyze, optimize, and continue creating new assets for. This often leads to ==subpar results== since ==your time and budget are spread so thin.== ==You can’t give each channel the attention it requires.==

- Our intention isn’t to scare you into thinking growth is impossible. But focus matters. Especially in the early stages of a company’s life. Let’s move on from hypotheticals to how we’ll help you apply this concept throughout the program.

- Acquisition channels

- We’re going to teach you our strategy and research framework, which will help you identify the one or two channels with the greatest chance of success. This course will also guide you in choosing the channels that are most likely to move the needle for your company.

- This is a major shortcut. You won’t need to test dozens of channels. You’ll be able to jump straight to the ones best suited for your company and goals.

- Experiments & A/B tests

- Early on, when you have limited resources, site traffic, users, and time, you have to be exceptionally thoughtful and intentional with what you decide to test.

- Why? Again, because we need big wins. Squeaking out 5% improvements isn’t going to cut it.

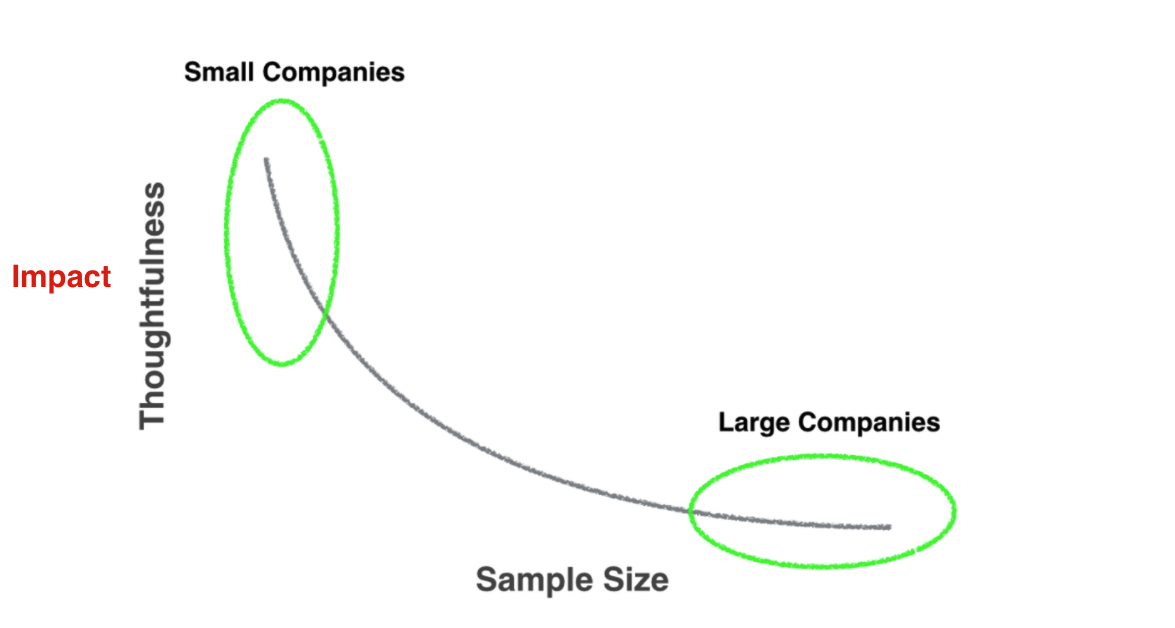

- Here’s a simple but powerful chart to illustrate the point:

- Large companies have tons of traffic and can collect massive sample sizes. This allows them to run lots of A/B tests that may only move the needle by a couple of percentage points. But a 1% improvement is significant for a company like Google (which explains their famous experiment in which they split-tested 40 different shades of blue on a single toolbar).

- It also allows them to be less thoughtful with what they test. If you can launch and conclude a test in a single day, it makes sense to lower your bar. Startups don’t have this luxury. Whatever we prioritize, we need to have high conviction that it will produce major results.

- Acquisition channels

# Growth = learning

#learning

- Summary: Apply all learnings—from successes and failures—to future growth initiatives.

- A good growth strategy emphasizes feedback loops. These allow you and your team to quickly learn what’s working and what needs to be improved.

- Growth is data driven. You’re going to learn how to apply the scientific method to your activities: hypothesis, test parameters, observation, and analysis.

- Most founders and startups struggle to learn from a failed experiment.

- Let’s look at some examples:

- You launch an ad campaign, but it yields few new signups.

- You launch a new feature, but it doesn’t improve your customer retention rate.

- You create content for a new channel, but hardly any sales come through.

- If you can’t understand ==WHY each failed== and ==HOW to ensure that it doesn’t fail again==, you’ve learned nothing.

- The opposite can also be said: If something is working but you have no idea why or how to continue growing it, ==you don’t really have a strategy. You simply got lucky.==

- You’ll learn how to create a growth strategy that includes ==systematic experiments.== Being systematic will help you know whether or not your experiments are worth continuing.

- You’ll also learn how to prioritize which activities to focus on. You’ll find out how to collect the right kind of information to know when it’s time to double down, or when to move on to the next experiment.

# Leverage compounds

- Summary: Focus on high-leverage activities for compounded growth.

- How do startups with only a few people experience explosive growth and win out against established industry players that are hundreds of times bigger?

- They apply an extreme amount of force to a single point of leverage. Leverage is what allows tiny companies to create massive change.

- Leverage compounds, meaning that ==the high-leverage activities you do today will allow you to do more with fewer resources in the future.== And as you learned in the last principle (growth = learning), those who learn fast begin generating compounding effects earlier.

- Therefore, to create maximum leverage, you’ll want to ==learn as fast as possible in the beginning== , so you can ==turn that knowledge into growth==, and ==growth into leverage.==

- Our program focuses on only high-leverage activities. We know your time is valuable, which is why our program focuses on HOW to execute high-leverage activities.

- Soon you’ll have a growth strategy that will keep you laser-focused on the opportunities with the highest likelihood of producing meaningful results.

# The staircase of growth

- Summary: Continuously optimize your business model for your channel.

- Growth often occurs in a step function, like stairs going upward. Here’s how it works:

- You’ll get a growth activity to work well. You’ll be acquiring new customers consistently, and your revenue will steadily increase.

- Then, for seemingly no reason in particular, growth will begin to slow. You’ll see all your growth outputs plateau.

- This tends to occur when you reach the ==upper ceiling== of a channel, market, or tactic—you’ve reached ==all the possible customers that a single channel can reach.== This is a sign that you’re ready to take a step up the staircase to the next level of growth.

- For example:

- Let’s say you’re selling a pool toy, and you start by selling door-to-door in your hometown. You know there are 10,000 pools within your town. The ceiling of selling using door-to-door as your growth channel is about 10,000 sales. Once you reach that point, you’ll have to find another way to reach pool owners.

- (You’ll learn about conducting market research and the specifics of each growth channel in later modules, so don’t worry about the details of this example.)

- Now let’s fast-forward: You’ve begun selling your pool toy through Facebook ads. You’ve now sold over 100,000 units, and things seem to be going well. But then you hit a plateau again.

- Was it because of a market ceiling? Considering that there are over two billion people on Facebook and over 10.4 million residential swimming pools in the US alone, it’s highly unlikely that you’ve hit a ceiling.

- What’s more probable is that you’ve hit the point of diminishing returns.

- We’ll explain this concept in more detail when you learn how to scale a growth channel that’s working. But essentially it means that you’re going to need to optimize your business model to match the channel you’re selling through.

- In future modules, we’ll share ways to identify whether you’re going to need to find a new strategy, and how to pivot when the time comes.